As spring makes its appearance across the Greater Toronto Area, the real estate market also presents new opportunities. This April, while we’ve seen a shift in market dynamics compared to last year, the increase in listings and stable pricing conditions are setting the stage for a promising season.

Spring Brings Renewed Opportunities to the GTA Market

Jennifer Pearce, president of the Toronto Regional Real Estate Board (TRREB) shared her optimism about the future: “Listings were up markedly in April in comparison to last year and last month. Many homeowners are anticipating an increase in demand for ownership housing as we move through the spring.”

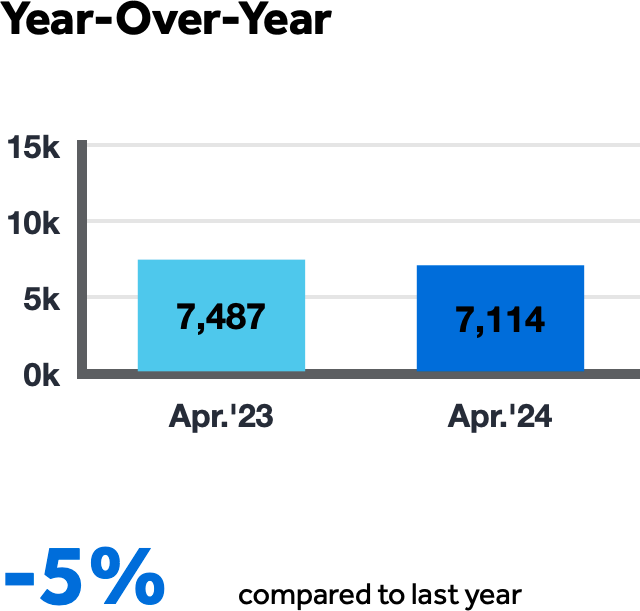

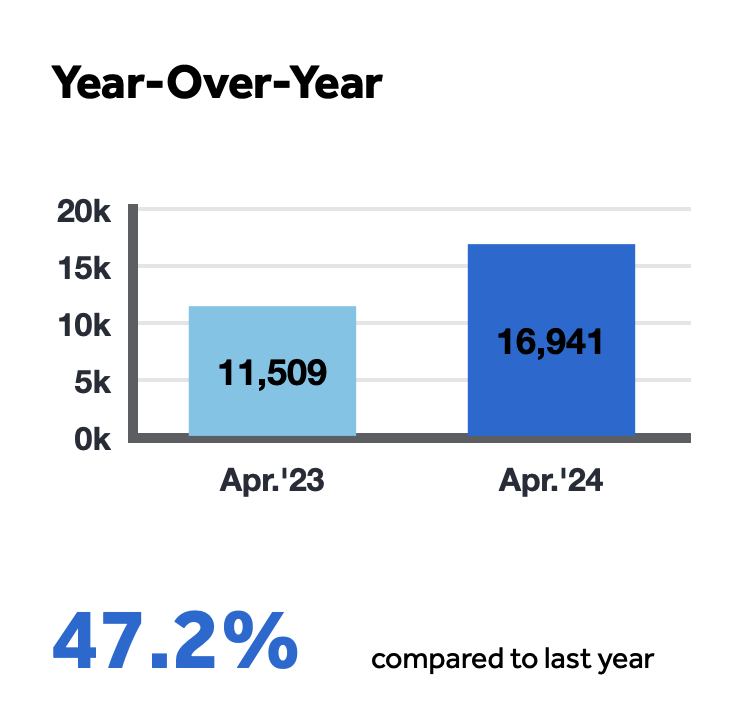

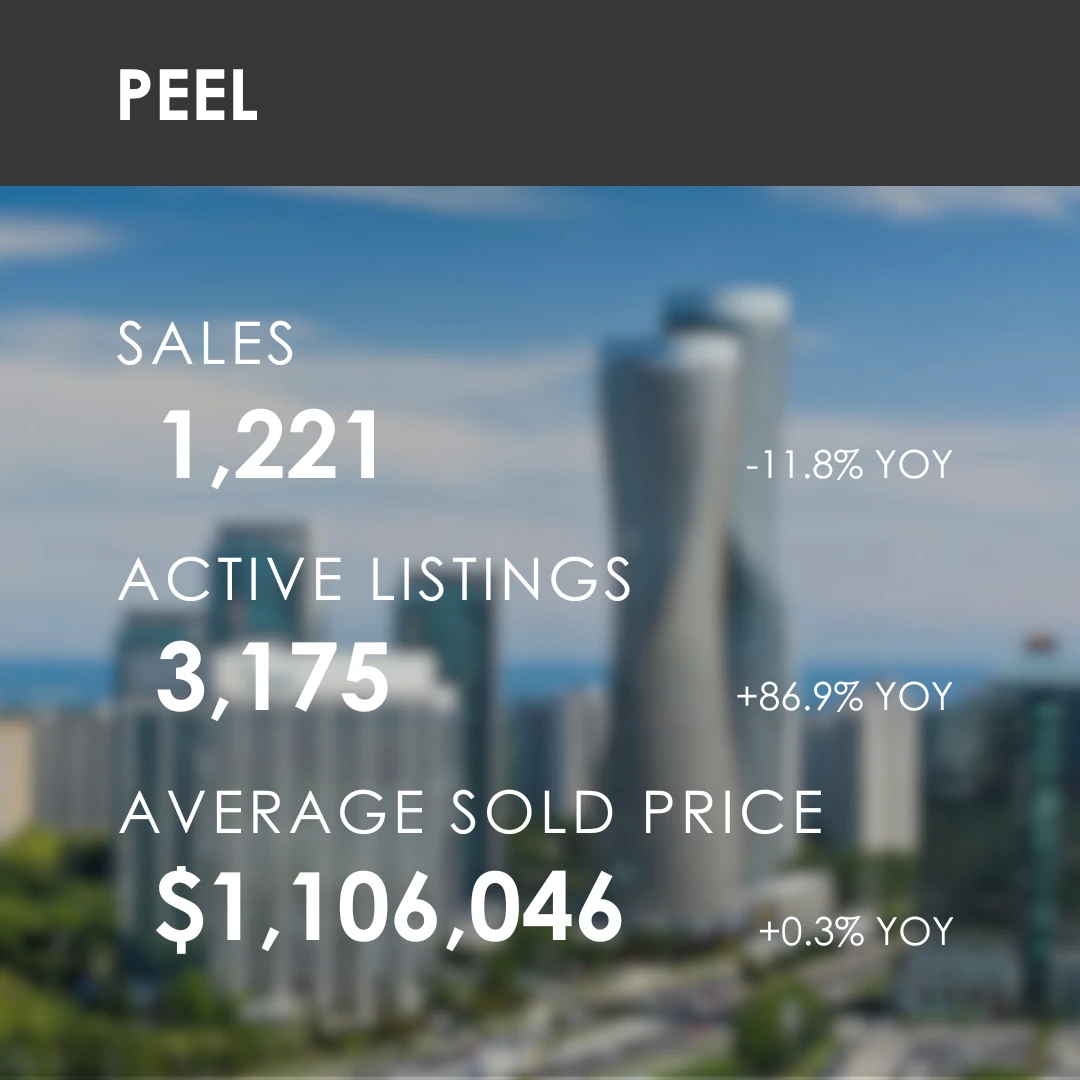

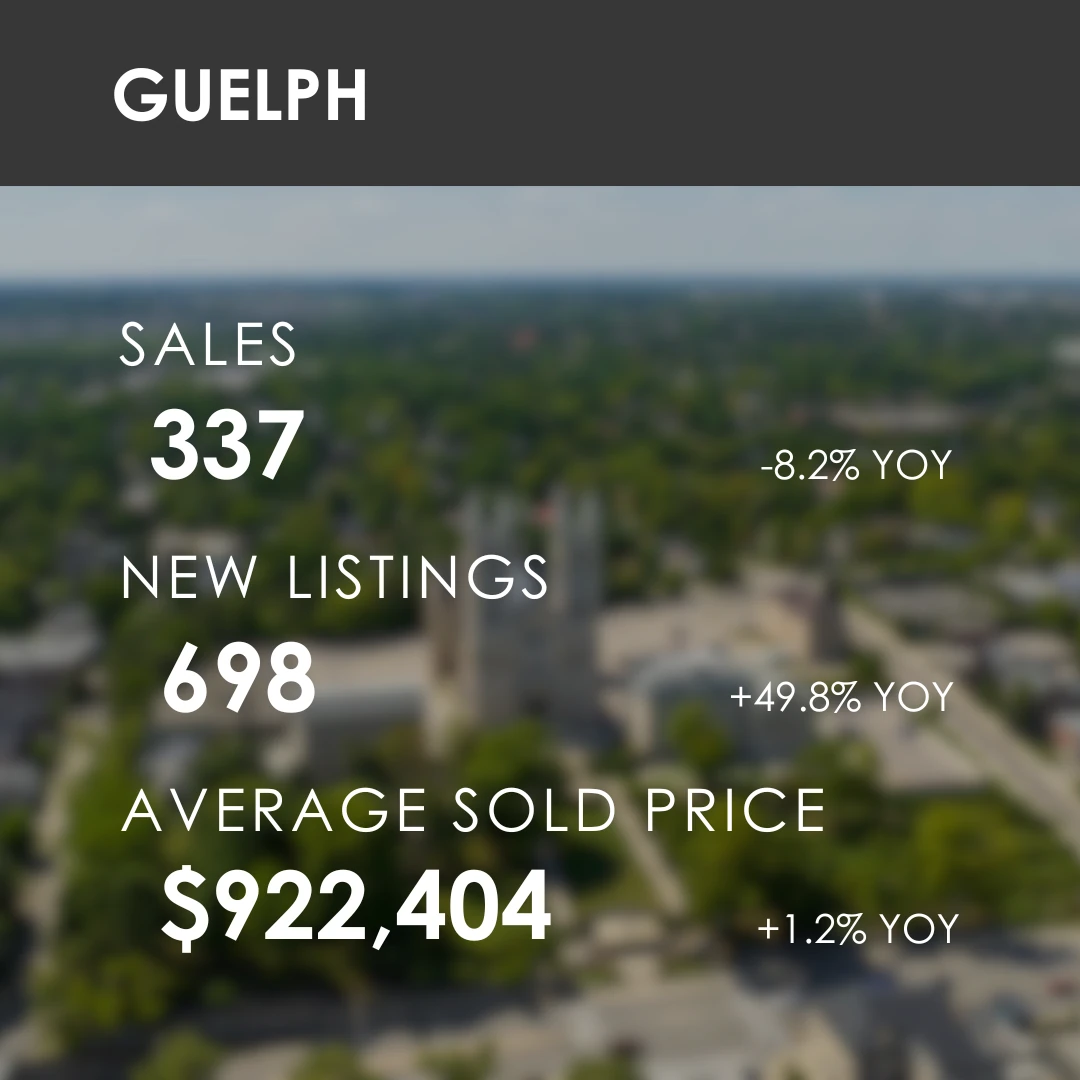

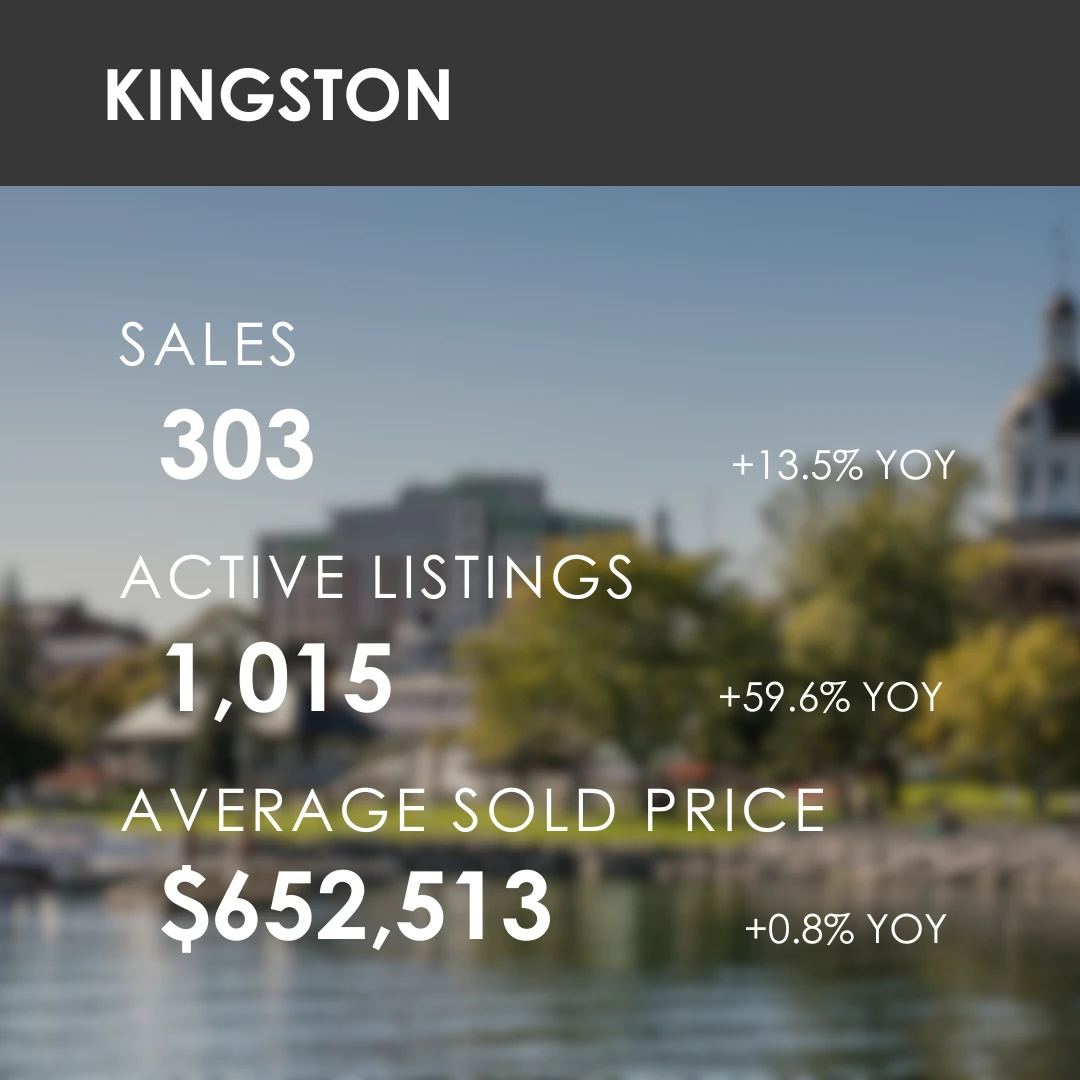

TRREB data shows that home sales reached 7,114 this April, reflecting a 5% decrease compared to April 2023. Despite this change, there is a silver lining for potential buyers: new listings have surged by 47.2% year-over-year, offering a broader selection.

Stability in Pricing

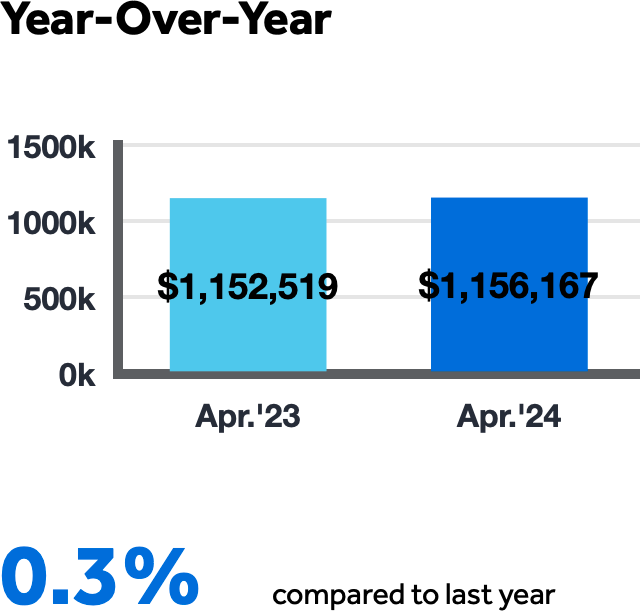

While the market has adjusted to the increased inventory, prices have remained stable. The MLS® Home Price Index (HPI) Composite benchmark has slightly decreased by less than 1% year-over- year, while the average selling price has experienced a slight increase of 0.3% to $1,156,167.

From March to April, on a seasonally adjusted basis, the average selling price also saw a healthy increase of 1.5%.

New Government Initiatives

TRREB CEO John DiMichele highlighted the critical role of government in shaping the future of real estate: “All levels of government have announced plans and stated that they are committed to improving affordability and choice for residents.” This involvement intends to set the foundation for a healthy and sustainable market, long term.

Contact the Vetere Team today

As we navigate through these changing market conditions, The Vetere Team remains dedicated to providing you with timely insights and award-winning guidance. Whether you’re considering buying, selling, or simply exploring your options, we are here to help you make informed decisions in this evolving landscape.

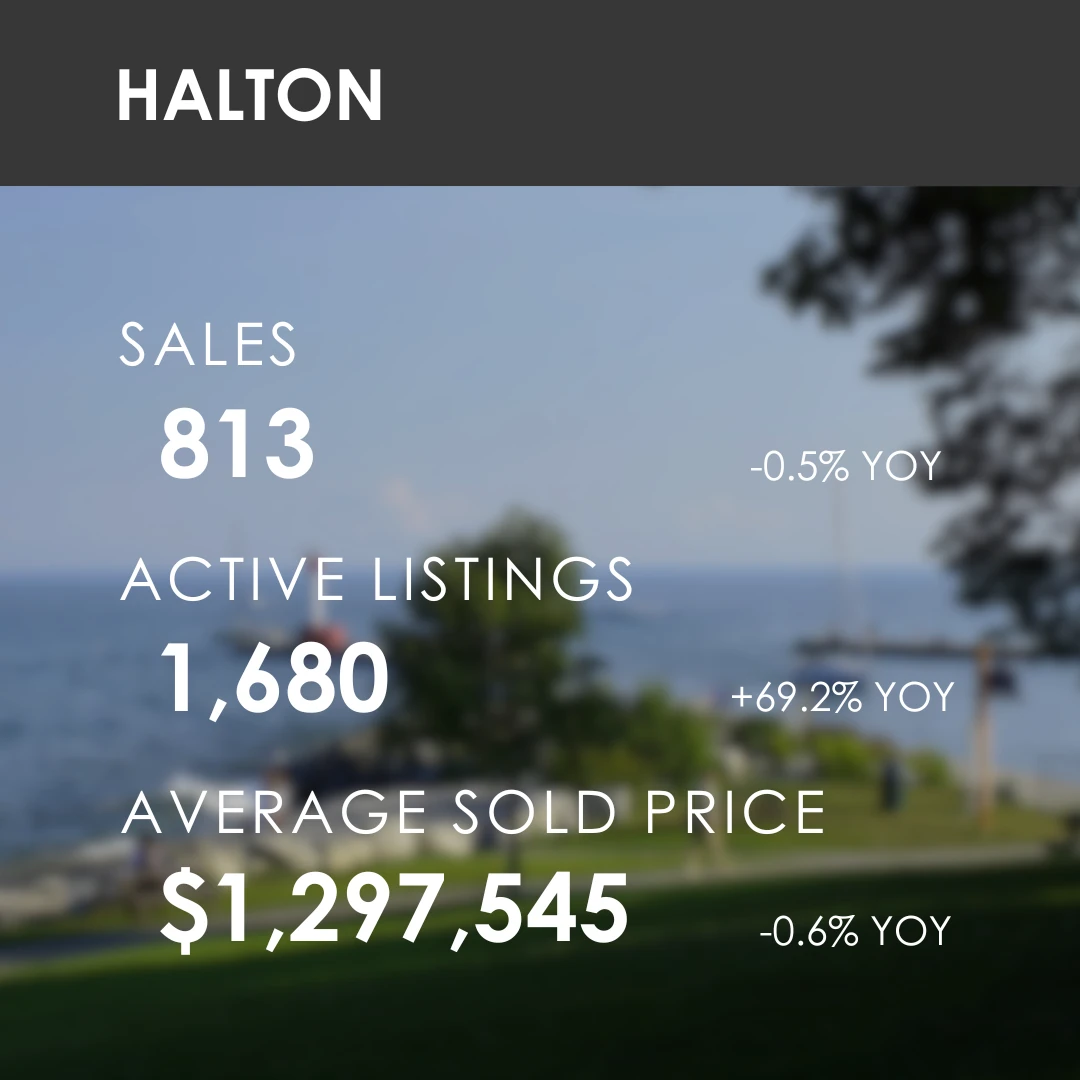

MARKET STATS

Canada’s economic landscape, as depicted in REXIG’s April 2024 economic outlook, portrays a nation on the brink of a gradual yet promising recovery. Despite grappling with substantial challenges like persistent inflation, increasing business insolvencies, and rising mortgage delinquencies, the country concluded 2023 with stronger-than-expected growth. This was supported by a resilient labor market and significant population growth, suggesting that Canada might sidestep a recession. Key drivers of the expected recovery include forecasted interest rate cuts starting in June, a robust influx of newcomers bolstering domestic demand, and encouraging economic indicators from the United States, marked by rising consumer spending and government investments.

High interest rates continue to strain household budgets and business operations, reflected in slowed export growth and cautious investment intentions. The real estate sector feels the pinch with higher mortgage renewals looming, impacting household spending power and overall economic sentiment. Despite these obstacles, there is cautious optimism for the latter half of 2024. The forecast suggests a modest economic revival driven by easing monetary policies and ongoing population growth, which should help stabilize the economy and gradually lead to a phase of renewed growth and stability, aiming for a more substantial expansion in 2025.

|  |

|  |

|  |

|  |