As we move past the midway point of 2024 and into the hottest days of summer, it’s time to take a look at how the real estate market is shaping up in the GTA for the latter half of the year.

Sales, Average Sale Price Down, Market Supply Holds Firm

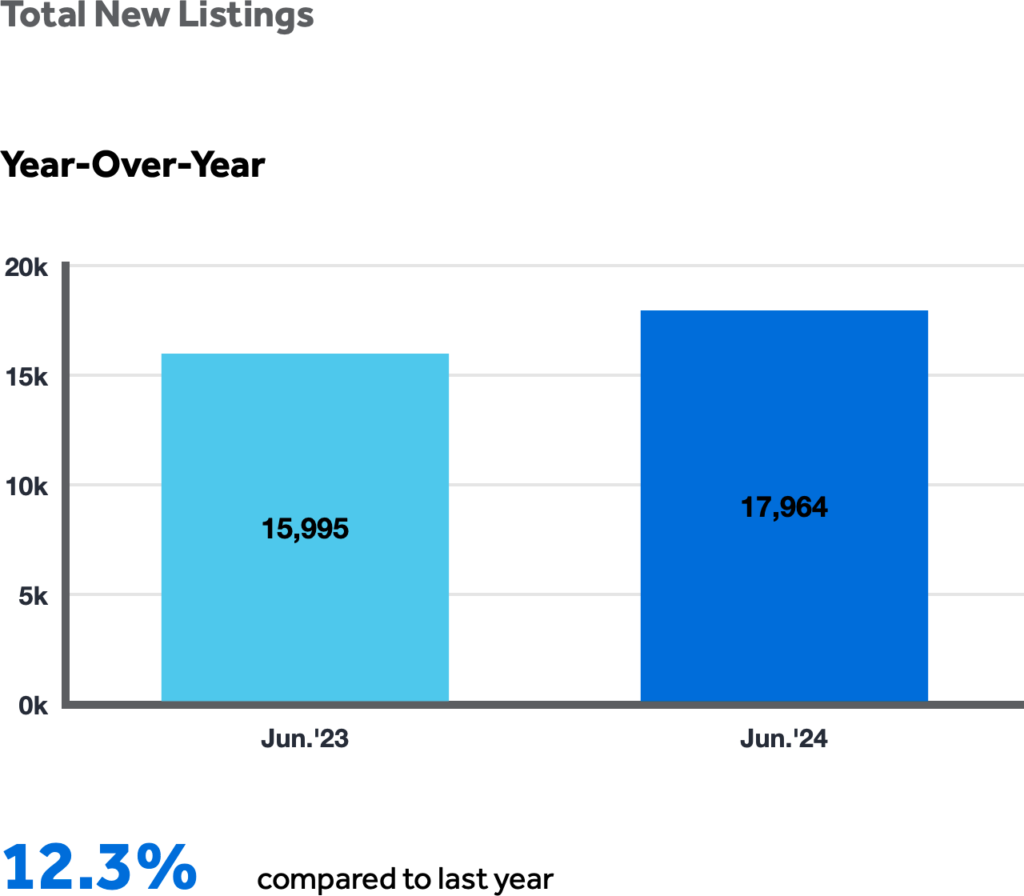

With new listings up 12.3% from June of last year, the market supply in the GTA is holding up to continuing long-term demand. “Despite a temporary dip in home sales due to high interest rates, we know that strong population growth is driving long-term demand for ownership and rental housing,” said Toronto Regional Real Estate Board CEO John DiMichele in the TRREB’s monthly report.

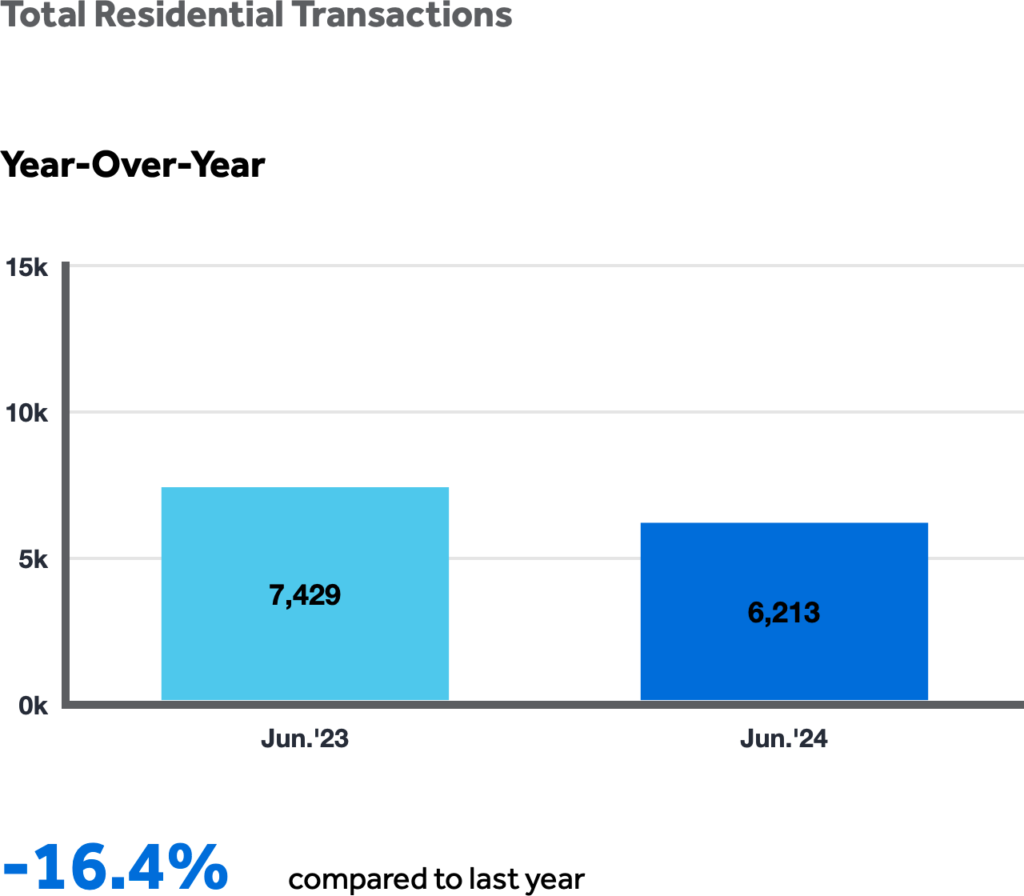

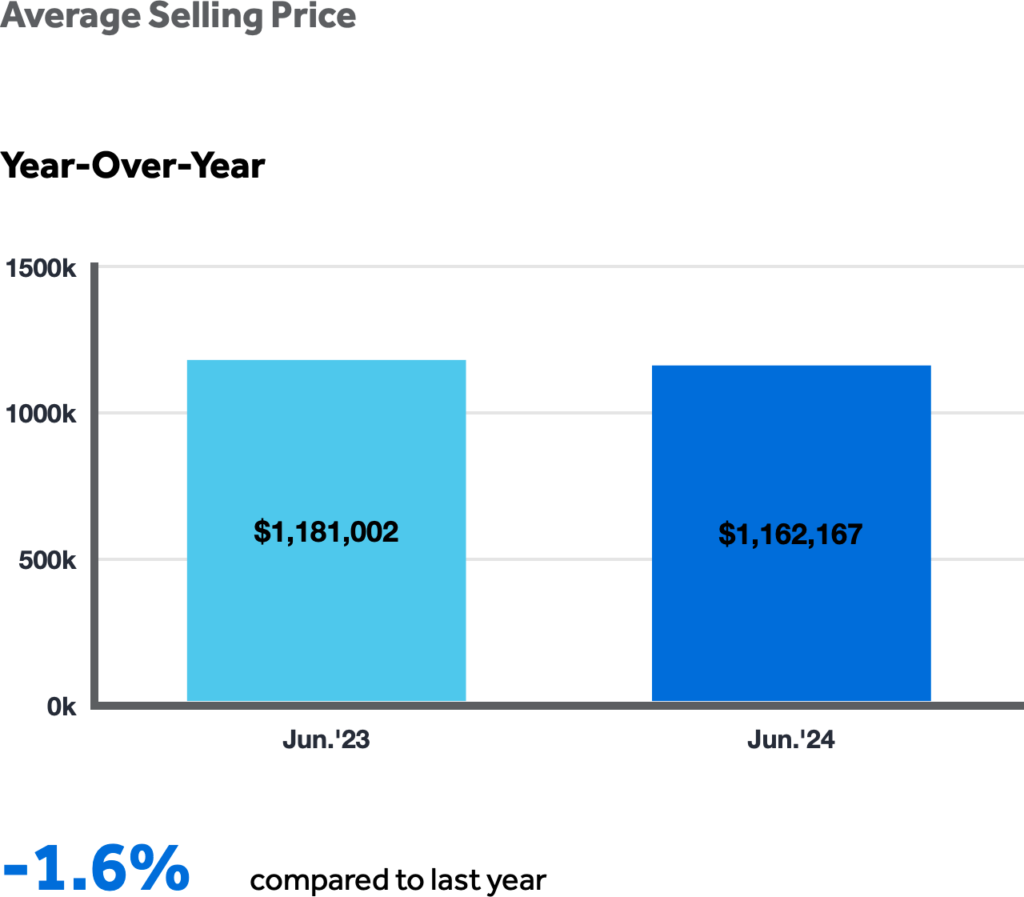

Sales in June 2024 (6,213) were down 16.4% from the same period last year (7,429), with the average selling price dipping slightly, down 1.6% to $1,162,167 year-over-year. The MLS® Home Price Index Composite benchmark was also down by 4.6 from last year.

Bank Of Canada Rate Cuts Provide Relief to Buyers

TRREB President Jennifer Pearce highlighted that despite the Bank of Canada’s rate cut early in the month, “the June sales result suggests that most home buyers will require multiple rate cuts before they move off the sidelines.”

With the market supply holding steady, and the promise of further rate cuts on the horizon, the current conditions seem to favour buyers and homeowners. “Moving forward, as sales pick up alongside lower boring costs, elevated inventory levels will help mitigate against a quick run-up in selling prices,” noted TRREB Chief Market Analyst Jason Mercer.

Contact the Vetere Team today!

With a combined 25 years of experience, whether buying or selling, the Vetere Team can help you navigate your real estate needs with sincerity and integrity. We look forward to hearing from you!

MARKET STATS

As 2024 progresses, the Canadian economy is navigating its way through economic pressures with a notable degree of resilience. The recent proactive measures by the Bank of Canada, which include the first interest rate cuts in four years, are strategically designed to temper inflationary pressures and stimulate economic growth. This approach reflects a strong commitment to adapting to global economic trends and supporting the economy during a crucial recovery phase.

//

Despite facing ongoing challenges, there are several promising signs in the Canadian economic landscape. The rate cuts are aimed at providing immediate financial relief to households, which could lead to increased consumer spending and investment. Furthermore, these adjustments offer an opportunity to catalyze improvements in regulatory frameworks and business investment climates. As financial pressures ease, consumer confidence is expected to grow, potentially leading to an uptick in economic activities and setting the foundation for a sustained recovery.

Future Outlook and Implications

Looking ahead, the Canadian economy is poised for a period of transformative recovery. The strategic adjustments made by the Bank of Canada are crucial in fostering a stable and dynamic economic environment. Moving forward, focusing on enhancing productivity and encouraging robust business investments will be key to driving long-term growth. By capitalizing on these strategies, Canada is well-positioned to not only rebound from current economic challenges but also to thrive and emerge as a stronger player in the global economy.

|  |

|  |

|  |

|  |