Last month, Department of Finance Canada announced changes to mortgage lending guidelines which included increasing the price cap for insured mortgages to $1.5 million, and expanding the eligibility for 30-year mortgage amortizations to all first-time homebuyers and buyers of new builds.

In this month’s newsletter, let’s take a look at how that impacted the real estate market in the GTA.

New Lending Guidelines, Lower Borrowing Costs Lead to Increased Sales

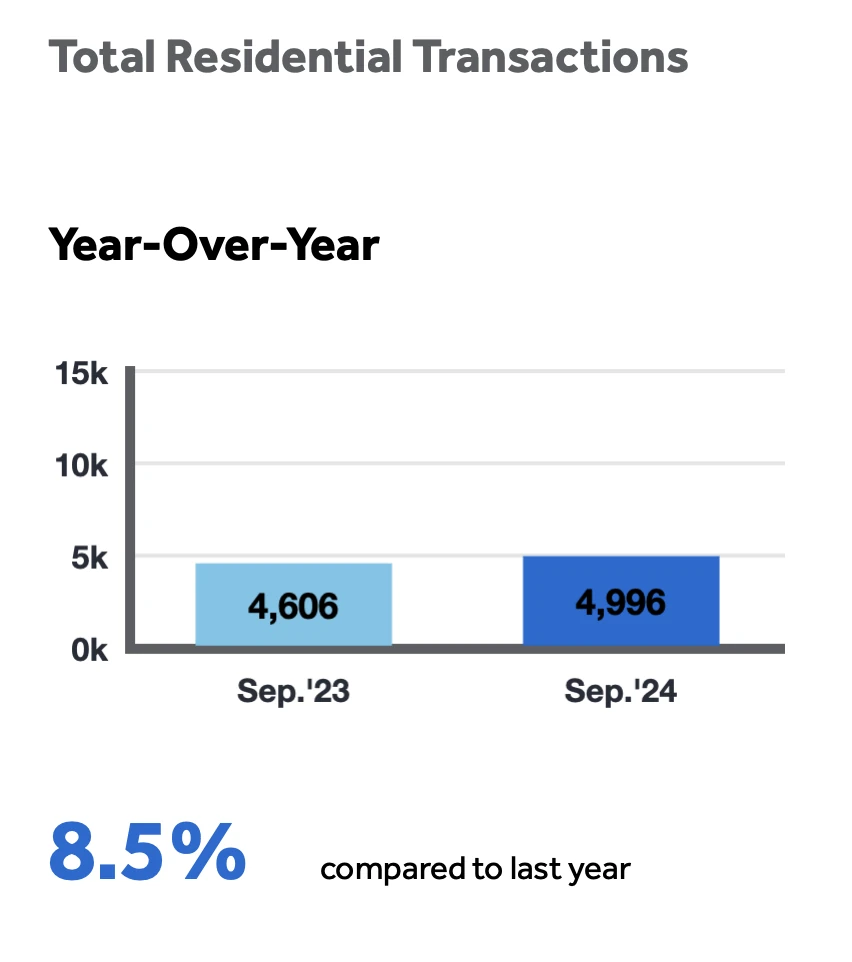

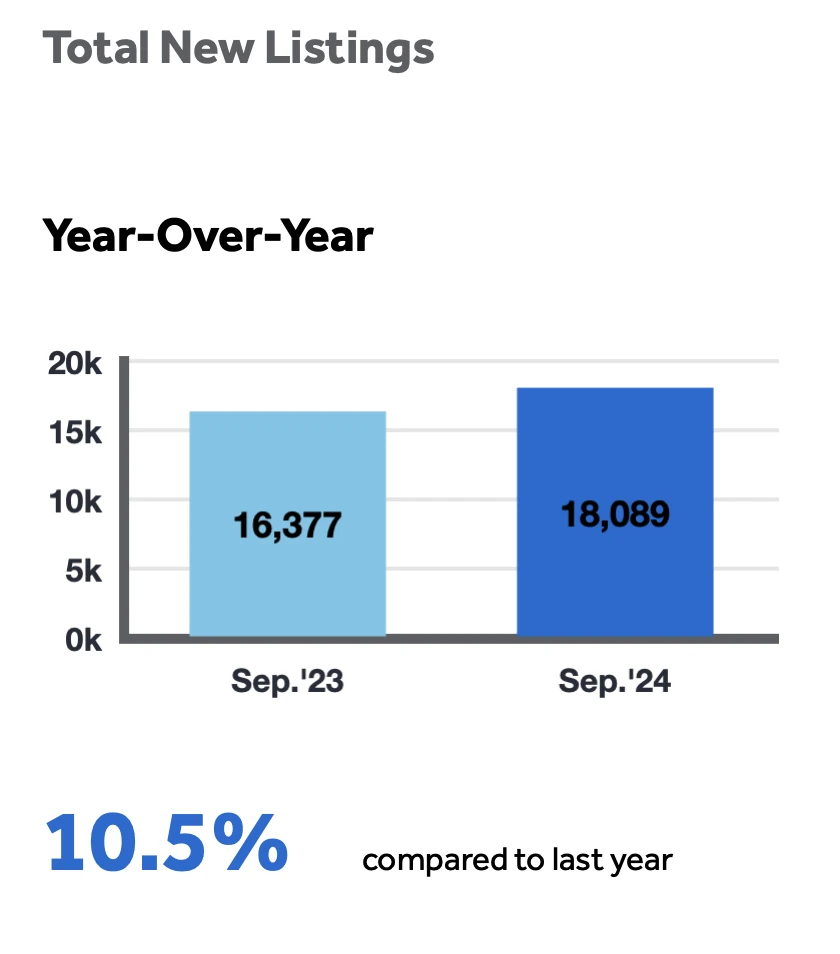

Alongside the aforementioned mortgage reforms, lower interest rates and home prices led to a surge in home sales in September, up 8.5% from the same period in 2023. New listings also increased as well in September, by 10.5% year-over-year.

Adjusted seasonally, sales were also up slightly from 5,326 in August of 2024, to 5,501 last month – an increase of just over 3%.

Average Sale Price Dips Slightly, Supply Meeting Demand

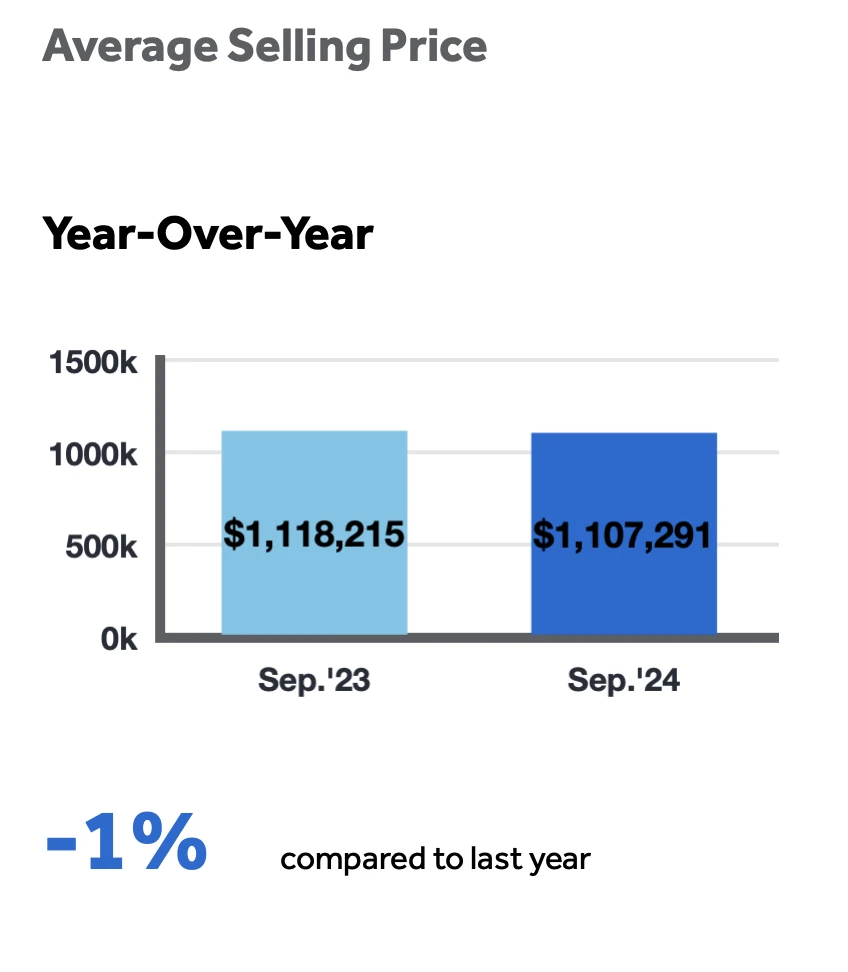

With new listings matching the increased demand from buyers, the average selling price in the GTA ($1,107,291) was down by just under a percentage point compared to September of last year ($1,118,215).

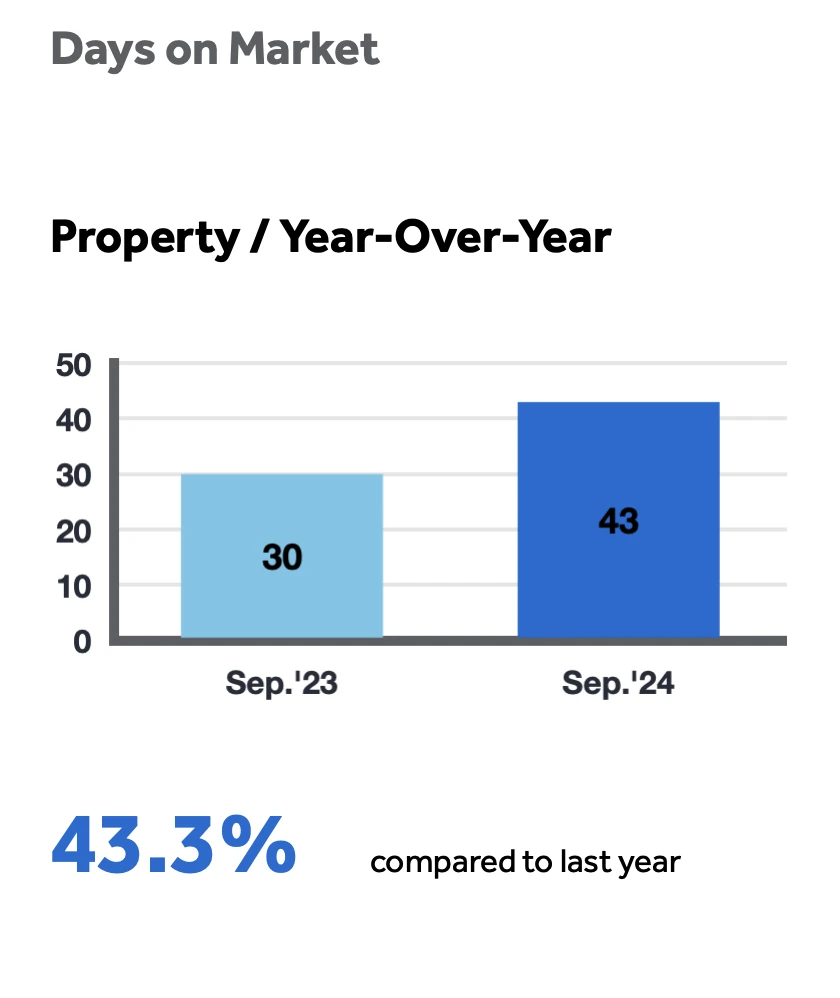

In the Toronto Regional Real Estate Board’s October 3rd report, Chief Market Analyst Jason Mercer highlighted a “better-supplied market” and “increased negotiating power for buyers re-entering the market”.

This, Mercer says, “led to moderate year-over-year price declines, particularly in the more affordable condo apartment and townhouse segments, which are popular with first-time buyers.”

Whether buying or selling – The Vetere Team is here to help

As always, contact us any time for any of your real estate needs. We have the knowledge and experience to assist you with your next purchase or sale!